Learn everything about growth stock vs value stock with Siam Tech Pro. Examples, charts and 2025 predictions. Find out which suits you best. Designed for US, UK, Canada, Australia and more.

Brief Summary

◾Growth stocks are future-oriented and higher risk; value stocks are stable and undervalued.

◾Real world growth stock vs value stock examples include Tesla (growth) vs Coca Cola (value).

◾Historical performance shows growth leading in bull markets, value holding strong in bear cycles in growth stock vs value stock

◾Reddit users often favor a mixed portfolio depending on market conditions and age.

◾ For 2025, experts suggest a balance of both, tailored to global trends and personal goals.

Introduction

Growth stock vs Value stock which is the best option? With Siam Tech Pro learn to invest and refine your portfolio. In this advanced guide there’s a answer of every question likely comes to mind. So if you’re a risk taker then each approach has its unique strengths. Your decision may depend on your financial goals and market trends. So start investing no matter if you’re in US, UK, Ireland, New Zealand, Canada, Singapore, Australia, France, Switzerland or in any other country. This article from Siam Tech Pro will help you understand these two investment strategies in depth.

What Is a Value Stock vs Growth?

A value stock is one that’s undervalued compared to its financial performance. These stocks tend to have lower price to earnings ratios and often provide dividends. They’re attractive to investors looking for stability and income.

On the other hand a growth stock represents companies expected to grow significantly faster than the market average. These firms typically reinvest their earnings, so they don’t often pay dividends but can provide higher capital appreciation.

So, when we compare a value stock vs growth, it’s often about slow and steady vs bold and fast.

Stock Market Analyze Before Investing 10 Best Step by Step Guides

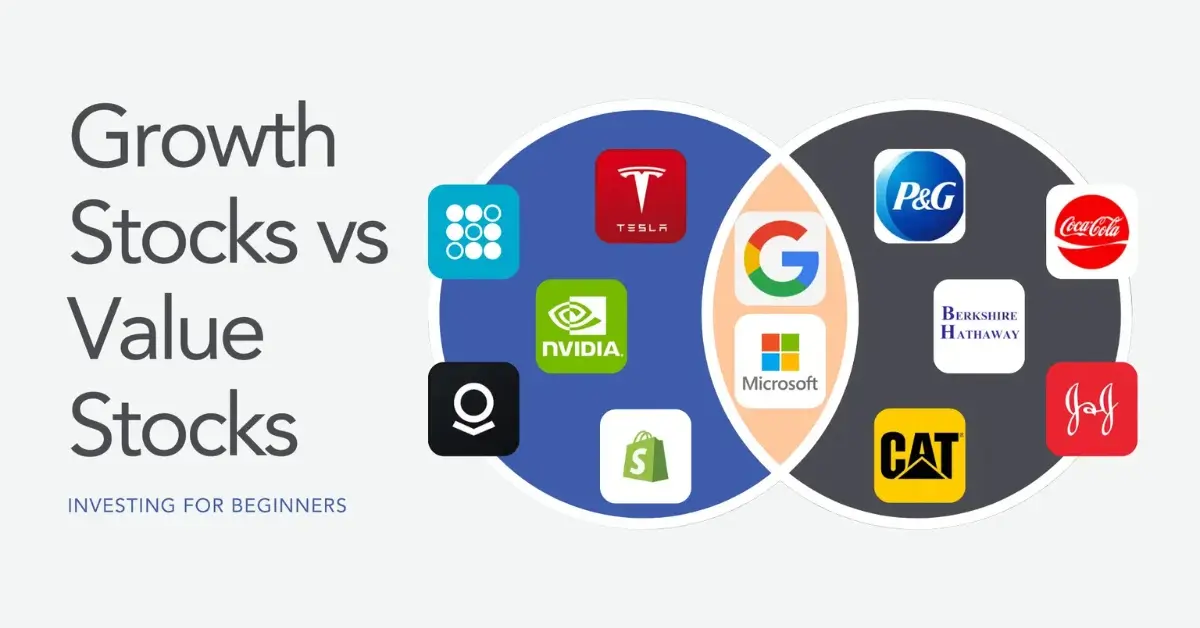

Growth Stock vs Value Stock Examples

Understanding the growth stock vs value stock concept becomes easier with real life examples.

Growth Stock Examples:

🌐Amazon – Massive reinvestment and future-focused.

🌐Tesla – Innovationdriven with soaring growth.

🌐Nvidia – Leading in AI and chips.

Value Stock Examples:

🌐Coca Cola – Stable earnings and dividends.

🌐Procter & Gamble – Consistent demand and strong balance sheets.

🌐Pfizer – Long-established market presence.

These growth stock vs value stock examples illustrate how different strategies suit different investors.

Growth Stocks vs Value Stocks vs Income Stock

Many investors also ask how these relate to income stocks. Let’s break down growth stock vs value stock vs income stock:

🎰Growth stocks: Ideal for capital appreciation.

🎰Value stocks: Offer stability and often dividends.

🎰Income stocks: Prioritize steady cash flow through dividends and are often a subset of value stocks.

Diversification among all three may be wise depending on your age and financial goals.

Growth Stocks vs Value Stocks Historical Performance

Let’s look at historical performance:

In the comparison of growth stock vs value stock 2010… growth stocks dominated, driven by big tech. But in 2022 when inflationary periods or interest rate hikes was going on, value stocks led the platform with best perform. In recent years, market rotation between styles has become more frequent.

Comparing growth stock vs value stock historical performance over multiple decades reveals that while growth has more upside, value offers protection during downturns.

Chart Overview – Growth stocks vs Value stocks

Using a growth stocks vs value stocks chart can help visualize trends. Over the last 10 years, growth stocks led the platform. It started from 2010 and went through almost 2020. But from 2021 to 2023, value stocks regained deal and took over the trends again.

In 2024, charts show a more balanced trajectory, prompting many analysts to suggest a blended approach.

Explore tools like Yahoo Finance or TradingView to monitor the latest growth stocks vs value stocks chart updates.

Growth Stocks vs Value Stocks Reddit Talk

On Reddit, particularly in forums like r/investing or r/stocks, the growth stocks vs value stocks Reddit discussions are ongoing.

Growth fans argue that innovation and AI will continue to boost growth stocks. Meanwhile, value proponents emphasize income and consistency. Especially in volatile times. Many Redditors now lean toward a 60/40 split or adjust based on economic outlooks.

These growth stocks vs value stocks Reddit opinions offer insights into real investor sentiments.

Learn how to Invest in Stock Market with Just $100

Forecast of 2025 – Growth stocks vs Value stocks

Now, let’s talk about what’s expected for growth stocks vs value stocks in 2025?

🎯If interest rates drop, growth stocks may outperform again.

🎯If inflation stays elevated, value stocks could hold strong.

🎯Sectors like tech (growth) and consumer staples (value) will be in focus.

For investors in Canada, the UK, or Singapore, many advisors suggest holding both styles and rebalancing based on global macroeconomic conditions.

Growth Stock Value Stock Definition Recap

Let’s clarify the growth stock value stock definition once more:

◾Growth stock = higher future earnings potential, reinvested profits, higher volatility.

◾Value stock = lower price relative to intrinsic value, dividends, less risk.

◾Mastering the growth stock value stock definition can lead to smarter decisions and portfolio balance.

Growth Stocks. Value Stocks. What Do the Labels Mean?

The terms can seem confusing, but they represent different investing mindsets. So what do growth stocks. value stocks. what do the labels mean?

They describe how investors categorize companies based on financial performance, risk profile, and potential returns. Value = cheaper, safer. Growth = expensive, aggressive.

(FAQs) Growth Stock vs Value Stock

1️⃣What is the main difference between growth stock vs value stock?

A: Growth stocks focus on future earnings and value stocks are undervalued relative to current fundamentals.

2️⃣Which performs better during a recession: growth or value?

A: Typically, value stocks perform better in recessions due to their stable earnings and dividend potential.

3️⃣Should I invest in both growth and value stocks?

A: Yes, diversifying between both helps manage risk and enhance returns over time.

4️⃣Are growth stocks more volatile?

A: Yes, growth stocks tend to be more volatile due to their high expectations and reinvested earnings.

5️⃣Which is better for beginners: growth stock or value stock?

A: Beginners may prefer value stocks for their stability but a mix can be beneficial depending on goals.

Final Verdict

So, growth stock vs value stock: who wins? If you’re in your 20s or 30s, growth stocks might align with your long term vision. If you’re nearing retirement, value stocks can offer peace of mind. Ideally, a diversified portfolio with both can weather all market conditions.

No matter if you’re investing from Australia, France, New Zealandt, US or any other country, strategy always matters. And a strategy that matches your goals is what matters most.

Stock Market Reviews 2025– Best Insights, Trends and Investment Strategy

Now that you know the possible opportunities waiting for you, Let us know in the comments below about your strategy and growth!

Also let us know from which country you reading this content?

USA, UK, France, Germany, Ireland, NewZealand, Australia, Switzerland, Singapore, Canada And Others?

Written By : MD. MUSHFIKUR RAHMAN

(Owner of Siam Tech Pro)

Authorised By : Siam Tech Pro

[…] Growth Stock vs Value Stock: Which Is Better for You? […]